9 November, 2022

9 November, 2022

- by Admin

Is your Canberra investment property ‘EV Ready’?

Electric vehicles (EVs) are coming fast, so ensuring your investment property is ‘EV Ready’ will be a big positive for Canberra renters – and save you money.

In fact, the advice from most car manufacturers is that by the early 2030s only electric vehicles will be manufactured. It is therefore predicted that within 20 years all new passenger vehicles on the market in Australia will be EVs.

The reason for this is that with technology rapidly advancing, and a vast variety of EV chargers available (some that are vehicle specific), being ‘EV Ready’ will allow for the easy installation of the most appropriate EV charger when needed.

Therefore, being ‘EV Ready’ means ensuring parking spaces in your investment property have appropriate wiring, covered outlets and a final connection point to accommodate future EV charging infrastructure.

Importantly, if your Canberra investment property is ‘EV ready’ you will save money on the installation of an EV charger when it is needed.

When it comes to EVs and EV charging stations the ACT Government report, Electric vehicle Charging Outlook for the ACT, Guidance for industry (December 2021), predicts that by 2030 the ACT will need to increase the number of public EV charging stations from 60 in 2021 to between 600 and 1000.

They are also predicting the number of EV registrations will increase from 1300 in 2021 to between 25,000 and 42,000 in 2030.

It found that ‘home charging’ makes up most of the EV charging needs for people with access to dedicated EV charging. But there was limited EV charging for those living in townhouses and apartments, especially those without access to their own parking space.

Based on current trends the suburbs of Kingston, Braddon and Civic will have the highest concentration of electric vehicles in 2030.

Maloney’s Property, Managing Director, Peter Maloney, said:

‘It is no coincidence that these Canberra suburbs are also forecast to have some of the highest proportions of apartments and townhouses in 2030 - therefore, if you are looking at an apartment as an investment property in Canberra’s inner north or south, you should consider one near EV charging stations or apartments that are ‘EV Ready’.

So, what can you do if you are considering a Canberra apartment as an investment property?

The best decision you could make when deciding on the right Canberra apartment for your investment property would be to partner with a real estate agent from Maloney’s Property who can advise you on what support for getting ‘EV Ready’ is available.

Maloney’s Property is one of Canberra’s most trusted real estate agencies, with over 30-year experience assisting first home buyers and property investors to get into the Canberra property market.

For example, Peter explained that property owners may be eligible for a zero-interest loan of $2,000 to $15,000, with up to 10 years to repay, under the ACT Government Sustainable Household Scheme, for things such as EV charging infrastructure and Household battery charging systems.

By partnering with Maloney’s Property, you can take advantage of their experience and local Canberra knowledge, including trends and changing government policies and regulations.

‘The ACT Government is planning to implement EV charging requirements for new developments in 2023 – but in the meantime, it is important to know whether your potential investment property is ‘EV Ready’,” Peter explained.

Peter says that the main benefits for property investors of investing in an apartment that is ‘EV Ready’ include, the potential for increased property value and rental income and substantial savings on having to retrofit an old building.

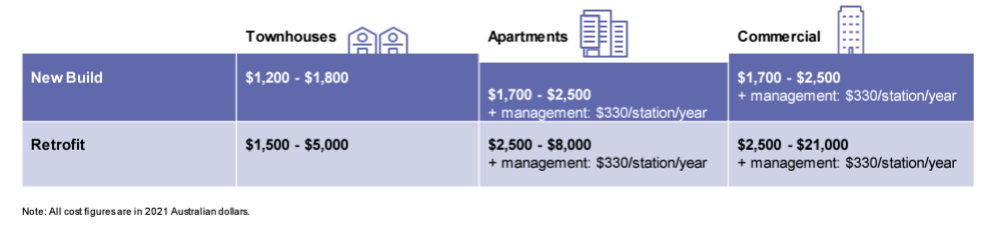

Costs associated with EV Ready infrastructure:

(Source: ACT Government: Is your building EV Ready?)

If you would like to discuss the benefits of an apartment investment in Canberra with EV charging facilities, then contact an experienced and friendly real estate agent from Maloney’s Property to set up a meeting.

Social Share

Subscribe To Our Newsletter

Want to be kept in the loop of upcoming sales, investment options, and local information before it hits the market?